Understanding the voice of your customer is essential to creating a winning strategy. In my previous post, I shared a few ways to use customer insights to inform your strategy.

In this second installment of my three-part series on customer insights, I'd like to offer these best practices to help you get the most from your customer feedback initiatives:

- Compare to competition

- Keep the right perspective

- Get quantitative data

- Different segments mean different interview questions

- Find out why you lose business

Let's jump in!

Compare to Competition

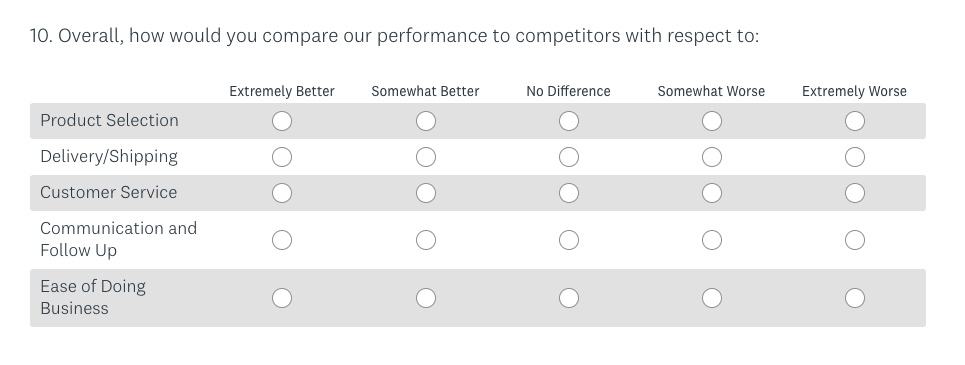

When designing customer feedback surveys, we are typically looking for how our customers view our performance against critical attributes that are important in delivering our value proposition. These are the attributes that should matter most to our customers.

A rating scale question is a great way to collect this feedback. I recommend when you ask your customers to rate your performance, you ask them to do it in comparison to your competition. Here's an example question:

Asking how you are doing relative to the competition is vital for two reasons.

- First, it gives you insight into areas of weakness you may have and gaps you need to close.

- Second, it gives your customers a reference point of comparison, making their responses more objective. For instance, overall ratings tend to be higher when asking to rate a company's performance against a list of attributes than when you ask those exact customers to rate those attributes compared to the competition.

The goal is to obtain insights that are as objective as possible and use them to inform your strategy. Comparing your performance to the competition is a great way to achieve that.

Keep the Right Perspective

Your Customer's Perspective Will Guide The Way

For example, in Customer Journey Mapping, design the phases and experience from the customer perspective. You want your customer to know you are genuinely interested in what they are experiencing throughout their journey and not just your business's impact.

People are busy. When customers are generous enough to share some of their time to help us improve our business, the questions we ask should have a clear connection to their needs and how we may serve them better.

Get Quantitative Data

I'm a big fan of qualitative data like customer interviews. This type of data provides opportunities for deeper dives into issues that can produce powerful insights. That said, I recommend qualitative data be paired with quantitative data, like Net Promoter Score and other performance ratings, in the following ways:

- To inform the deeper-dive customer interviews

- To provide benchmarking and comparative metrics

Inform Customer Interviews

Quantitative survey data is a great way to provide insights into potential opportunities and challenges you want to understand better. This data can highlight trends that you want to explore further with customers. Use quantitative survey data to help you hone in on the most critical issues you want to focus on when you talk 1:1 with customers.

Provide Benchmarks & Comparative Data

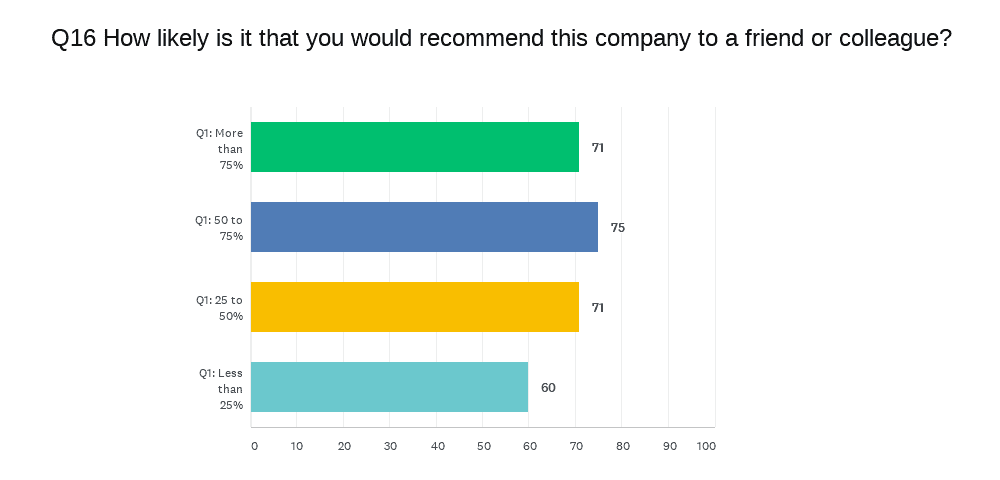

Using metrics like Net Promoter Score and performance rating data provides benchmarks and measures regarding how you are doing over time. It allows you to see changes and trends that you'll want to investigate. It also allows you to make comparisons against customer segments. For instance, you can compare Net Promoter Scores by segmenting how much volume the customers do with you.

In this example, we've segmented customers based on how much of their business they do with Company X in Q1 of the survey:

Comparative analysis is tremendously valuable for identifying trends and for use in root cause analysis.

Different Segments, Different Questions

I recommend you use the same quantitive survey questions across all of your customer segments. But when you have a chance to interview customers, your focus might shift depending on that customer segment.

Your Best Customers

Your best customers likely make up most of your business. So, of course, it's critical to stay very close to them and understand their needs. They also know you the best and will know when performance has shifted in your organization. Ask them:

- What are their future goals and growth plans, and what do they see as their biggest challenges? This provides an opportunity to understand where they are headed and make sure you can meet their changing needs.

- Are there mix shifts in the products or services that they get from you? You'll want to know what is driving those decisions. Is it a reflection of changes in their business or the industry overall?

- Have they experienced any changes in the level of service or quality of products? Customers feel the process breakdowns in your business, and your biggest customers will be most likely to feel the effects first.

- What's one thing you could do that would make doing business with you easier? This question uncovers frustrations your customers have that may not be material at the moment, but they could become a considerable problem if left unaddressed.

Customers With Declining Sales

Customers with declining sales can tell you a lot, and you'll need to understand if the decline is a market phenomenon or if they are buying less from you.

- Are their sales down because their business is contracting? Business contraction could be a market signal that is vital to your business. It might also be an opportunity to provide added value if there is a way for you to help them grow their business.

- If their sales are down with you because they are buying more from the competition, you need to learn everything about why they are choosing your competition. What is the competition doing that you are not? What are some specific examples when you have lost their business, and what was their process for choosing the competition? What might you be able to do to win back that business?

- Look for mix shifts. Are the sales down across the board, or are there specific categories declining? These declines can signal problems you might have in particular areas that you want to address immediately.

Lost Customers and Prospective Customers

Lost customers provide great insight into potential market disruption, challenges, and competitive threats. Prospective customers will offer valuable feedback about your competition.

- Ask lost customers why you lost their business. Was it a triggering event, or was it a gradual process? What was their decision process, and how specifically is the competition serving them better? Is there a potential market disruption at play? If you have quantifiable survey data from the customer, take a look and see if there were indicators that you missed, like a declining Net Promoter Score or performance ratings.

- Talk to Non-Customers: Survey your non-customers to understand how they think of your brand relative to the competition. What are their objections, or do they lack awareness of your brand? Why do they do business with your competition? What do they think the competition does better than you? Are there areas where they are currently underserved? Under what circumstances would they consider doing business with you, and what would that process be? How might you make the process and costs of switching to your company easier for them?

Download my

“25 Great Questions to Ask Your Customers”

Find Out Why You Lose Business

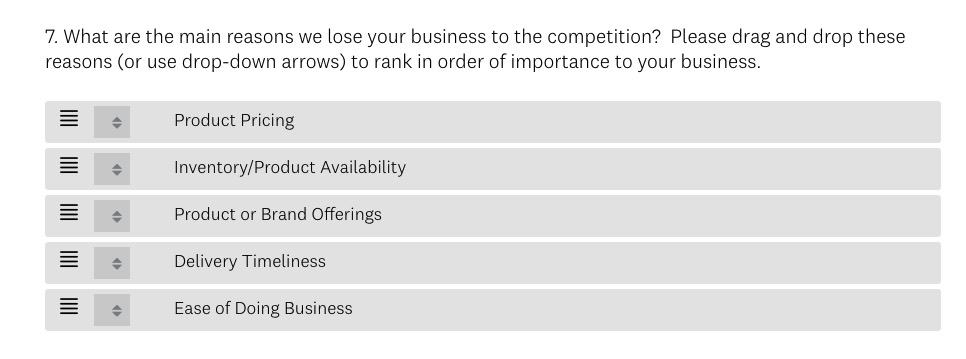

We've covered the importance of talking to customers with declining sales or customers with whom you've lost business. But I recommend quantitatively asking all of your customers to provide feedback on when you've lost business. Even your best customers may have had to buy from your competition in certain instances, and you need to understand that.

Include a question in your annual survey that reads something like this:

“Are there instances in which we have lost any of your business to the competition?”

If they reply, “yes,” ask them via a drag and drop rating question below, “What are the main reasons we lose your business to the competition? Please rank in order of priority.”

Here's an example:

I prefer a ranking question over a checkbox because you want the customer to share what factor was most important in the decision. Of course, there may be several, but this forced ranking will uncover the most important reasons.

The responses to this question will provide valuable insights into areas that you need to improve. It will also shed light on differences among customer segments.

You can also add a qualitative follow-up question to the survey like “Would you help us out by providing a specific example of when we lost some of your business?” If the customer is willing to take the time to answer that question, it will go a long way in providing context and greater clarity around potential problems.

Obtaining customer feedback is an investment for both you and your customers. Following these best practices will help you ensure you get the most from those efforts.

In the last part of my three-part series on customer insights, I'll share with you how to operationalize customer insights. Continuous collection of customer insights and synthesizing the feedback is a powerful way to stay competitive and keep your strategy relevant.

Why don't you sign up now for my insights so you don't miss this valuable series?

If you'd like help mining and leveraging your customer insights or if you'd like guidance creating a focused roadmap for growth that clarifies priorities, aligns resources, and ensures the successful execution of strategic goals that will transform the organization, please contact me.

I'd be grateful if you'd share this article with anyone else you think would find it helpful!

Work well,